Overview

This version of the Volume-Weighted Average Price ( VWAP ) indicator features an extended algorithm, which, in addition to volume and price, also incorporates regression analysis. The result is a more responsive, often leading VWAP slope with a degree of statistical predictability built in. Just like with the original VWAP , NEXT Regressive VWAP offers two optional Standard Deviation bands that parallel it. These can be set to any deviation level, with the default being 1 and -1, indicating one standard deviation above and one below Regressive VWAP , respectively.

Below is a screenshot comparing NEXT Regressive VWAP (green) to the original VWAP (blue) on ES (S&P 500 futures) M3 chart.

Key Features

- Regression analysis driven VWAP

- User-configurable (variable) regression scale

- Low to no lag and predictive (via linear regression)

- Native alerts via TradingView, including VWAP and VWAP Standard Deviation band crossovers

- Free, available for TradingView – a free platform

Input Parameters

There are 3 groups of input.

Regression Settings

- Length – controls the length of time (in bars) for regression analysis with higher values yielding smoother, more reliable values.

- Regression Weighting – let’s you control how much of the regression analysis you’d like to incorporate into VWAP, with 5 being average, 0-4 less, 6-10 more. The higher the value, the more responsive the Regressive VWAP curve.

VWAP Settings

- Anchor Period – controls the origin of VWAP calculations with start of session being the default.

- Source – data used for calculating the VWAP, typically HLC/3, but it can be used with other data as well.

- Offset – shifting of the VWAP line forward (+) or backward (-).

Standard Deviation Bands Settings

- Calculate Bands – checking this will add 2 bands, each equidistant from the Regressive VWAP line.

- Bands Multiplier – standard deviation multiplier, with 1 being the default.

Strategies

Bias and Probability Plays

Price above Regressive VWAP is interpreted to have a bullish bias, and below, bearish. You can use TradingView’s native Set Alert functionality to be notified, in real-time, when price crosses Regressive VWAP, and/or any of its standard deviation bands. Another popular “probability play” strategy is to scalp price when it crosses under the upper band (long) and crosses over the lower band (short). The screenshot below visualizes such a strategy on QQQ (Nasdaq 100 ETF) M1 chart.

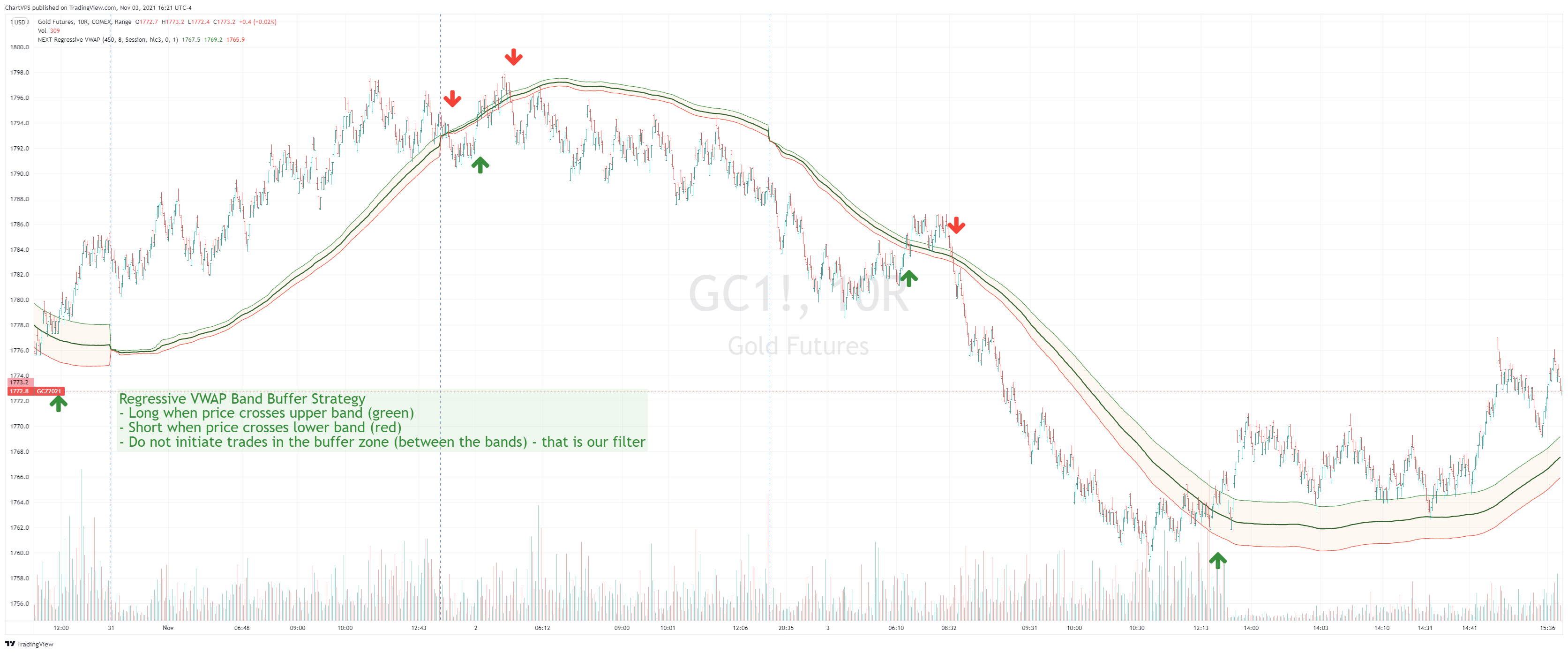

Band Buffer Strategy

The rules are as follows

- Long when price crosses upper band (green)

- Short when price crosses upper band (red)

- Do not initiate trades in the buffer zone (between the bands) – that is our filter

Interactive chart of the below GC (Gold futures) 10-Range Regressive VWAP Band Buffer Strategy screenshot can be found on our TradingView Ideas page.

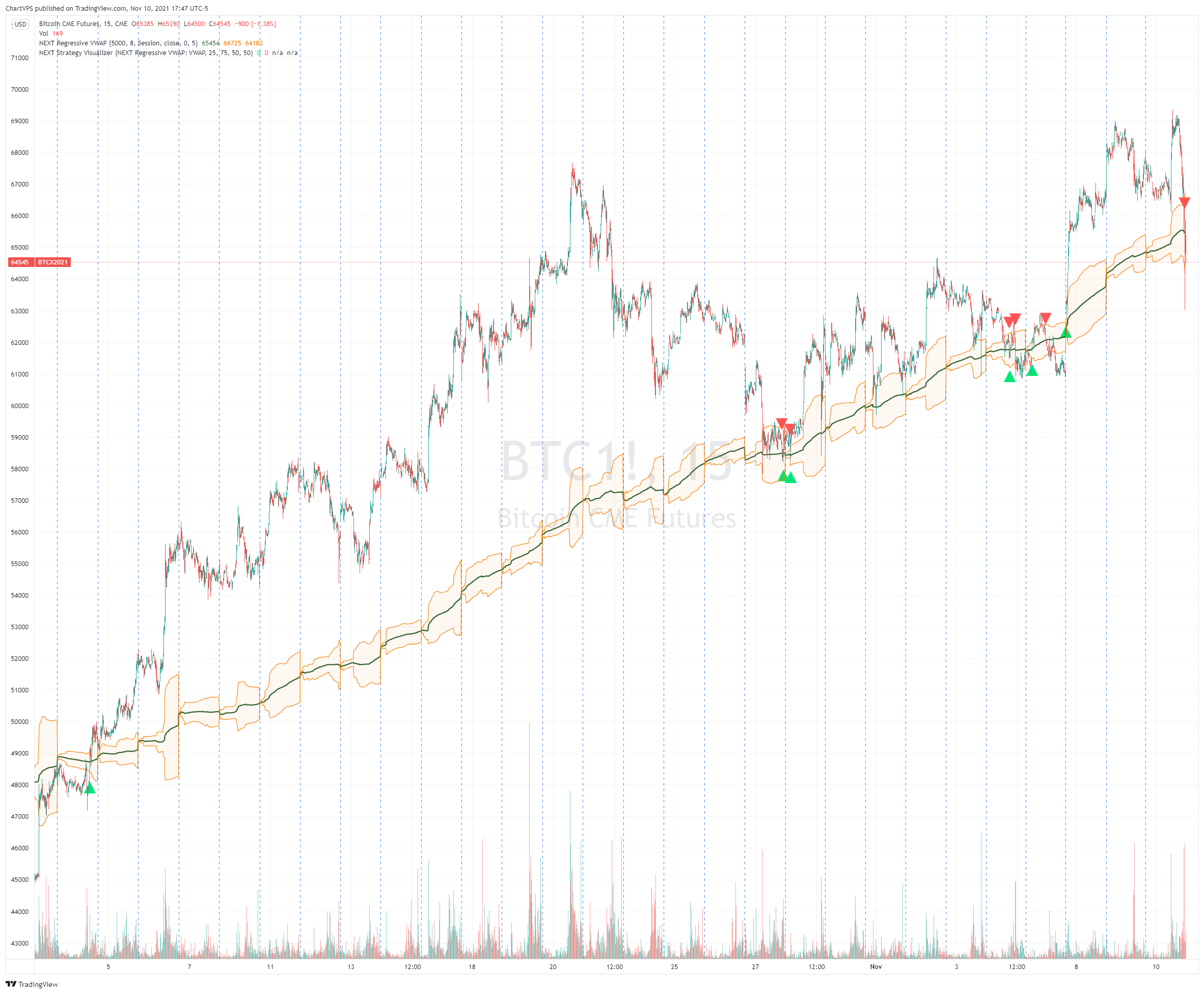

R-VWAP Breakout

- Long Entry on Close crossing over Regressive VWAP

- Short Entry on Close crossing under Regressive VWAP

- Optional: exit when price retraces to upper band ( LX ) or lower band ( SX )

- You will need the free NEXT Strategy Visualizer add-on for plotting long/short arrows

The key to this breakout strategy is the Regressive VWAP, which weighs Price and Volume with Regression Analysis, making the slope and its bands more responsive, with a degree of mean reversion. The screenshow below demonstrates the strategy on Bitcoing futures (BTC) M15 chart. For the interactive version of the chart see our TradingView Ideas page.

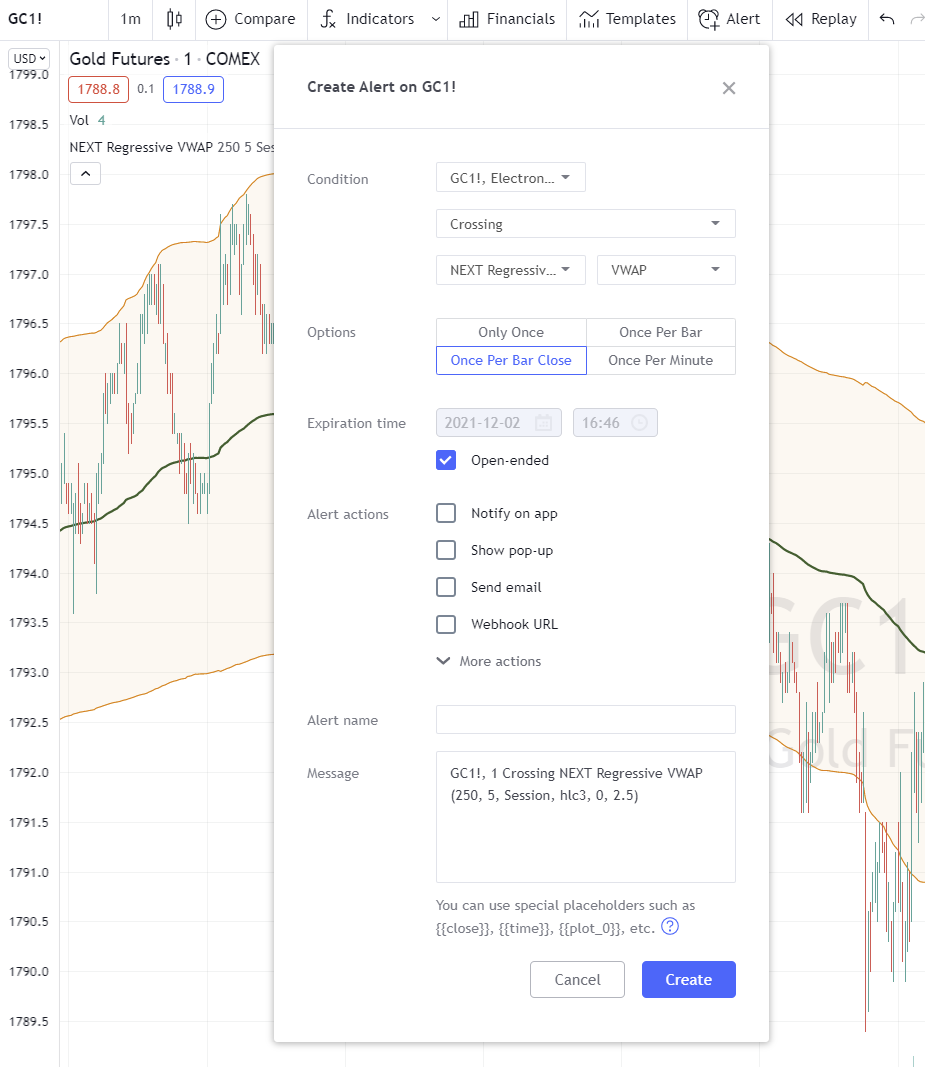

Signals and Alerts

Here is how to set price (close) crossing NEXT Regressive VWAP alerts: open a chart, attach NEXT Regressive VWAP, and right-click on chart -> Add Alert. Condition: Symbol, e.g. ES (representing the close) >> Crossing >> Regressive VWAP >> VWAP >> Once Per Bar Close.

Download

TradingView is our platform of choice for publication of the NEXT framework (indicators, strategies, etc.). The platform is free to use (Basic plan) with optional paid features, if you need them. You don’t for NEXT when using a single chart. Their fair approach to empowering retail traders aligns with ours. Trading should not be exclusive to hedge fund managers and professional traders. You can find all of our algo-driven software on the ChartVPS TradingView Scripts page. If you do decide to go with a paid version of TradingView (not required for ChartVPS NEXT), you can use this link to get up to $30 off.